What Is The Usual Starting Credit Score

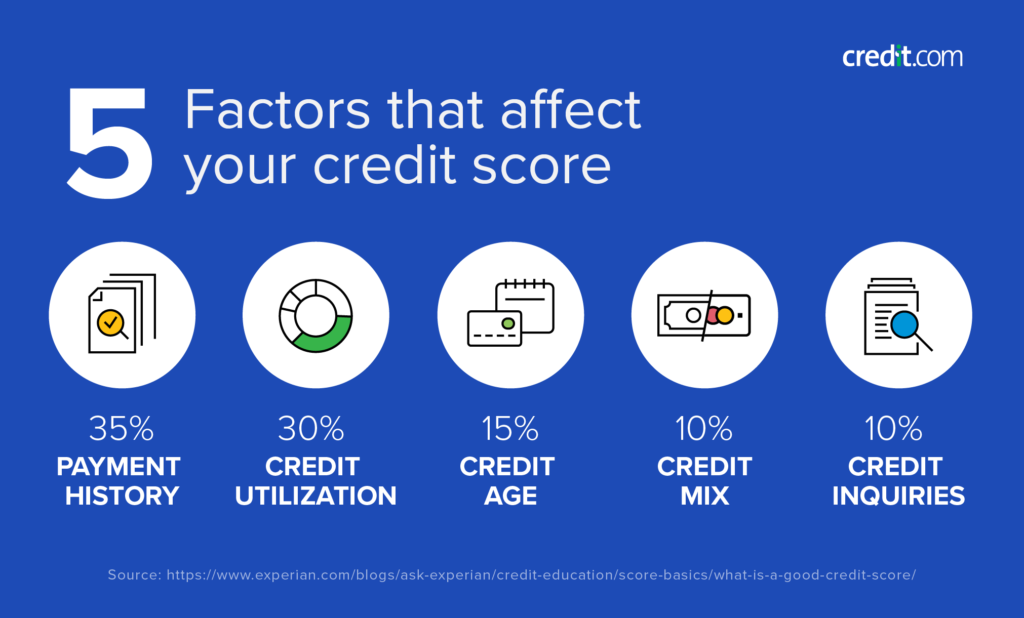

Credit mix (having accounts such as mortgages, loans and credit cards), about 10 percent; Gscore is your overall trust score from using gcash!

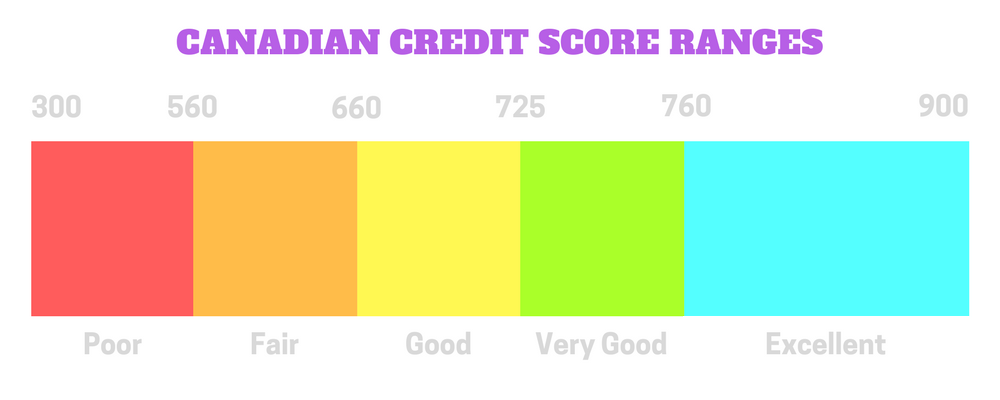

Here are the fico ® score ranges:

What is the usual starting credit score. Take the fico fitness challenge. To qualify for a bj’s perks credit card, you must have a credit score that’s considered “good,” or at least 700. When you start out with credit, it’s perfectly normal for your first credit card to have a sm all credit limit.

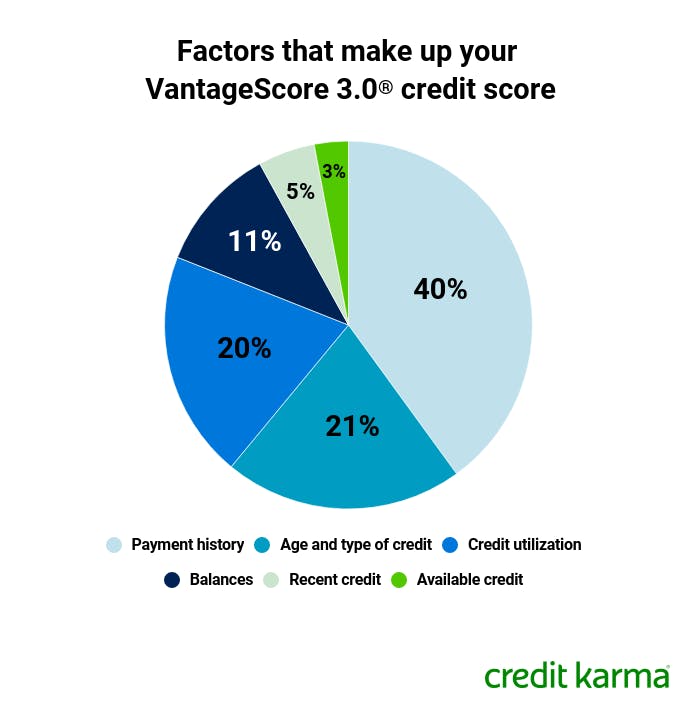

A good credit score is a fico® score of 670 or vantagescore 3.0 score of 700 or better and are in prime score territory. Keep your credit cards active by using them periodically. It increases depending on how much you use gcash to buy load, pay qr, pay bills, invest, save and other gcash features.

Other considerations are length of credit history, about 15 percent; It’s unlikely to be that low, either. It looks like theu double your limit in 6 months.

Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45% of your number. How do you stack up? After reaching a specific score, you will be able to unlock gcredit.

Get your free score on credit.com. It’s good to pay your bill in full each month to avoid finance charges. But i know store cards usually tend to give higher limits than credit cards.

Ad includes full & instant access to your report & score plus credit monitoring. According to experian data, the average credit card limit as of december 2016 was $8,071. Finally, if you have a lot of credit cards already, don’t close them in the hopes that it will boost your credit score.

Your gscore will determine your credit limit; A fico ® score of 711 is considered good by most lending standards. Any score above 700 is considered good to excellent and will help you get the best available interest rates on most credit cards.

Fico ® scores, which range from 300 to 850, are the credit scoring model most commonly used by lenders for evaluating a borrower's creditworthiness. That’s based on a credit score of 300 to 499, which is the starting point for someone with little or no credit. And new credit (or credit inquiries received from new creditors) about 10 percent.

Approximately 21% of americans had a fico ® score that fell in the good credit score range in 2020. Credit limits will tend to be much higher for consumers with higher credit scores, just on the edge of prime. Your score may actually drop if you close old accounts.

Credit scores between 650 and 700 are average, while scores below. Americans have an average of $22,751 in credit available to them across all their credit cards. As you’ll see below, there is a wide range in credit card limits because consumers with low credit scores can’t access high.

That’s relatively unchanged from december 2015, when the average credit card limit was $8,042. You can usually raise your credit score by paying bills on time, addressing your debt, and reviewing your credit report for errors. Credit reporting agencies—like experian, transunion, and equifax—compile your credit history to help credit card companies decide your credit card limit.

Ad includes full & instant access to your report & score plus credit monitoring. Cnbc select offers tips on how to get a higher credit limit. The higher your gscore, the higher your credit limit.

My significant other hot a pre qualify via credit karma. I was recently approved for a target card and they gave me a 1k limit. The average credit card limit.

The average first credit card limit is around $1,800, according to experian. If you’re rejected for the credit card, you may need to work on increasing your credit score.

0 Response to "What Is The Usual Starting Credit Score"

Post a Comment