Nys Tax Fresh Start Program

Irs fresh start qualification assistance. How you may be able to get a fresh start with both the irs and the new york state department of taxation and finance.

The irs fresh start program makes it possible to avoid tax liens as well as to get existing tax liens withdrawn.

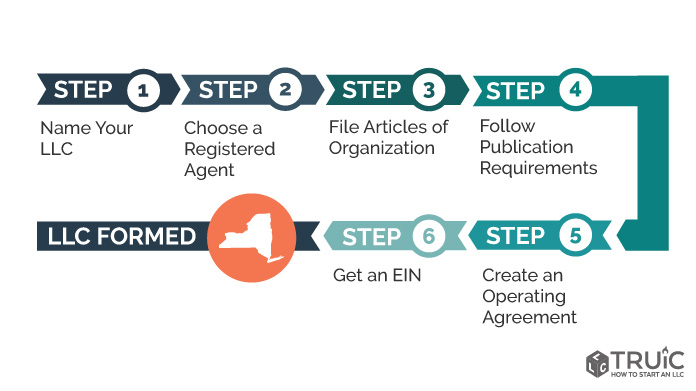

Nys tax fresh start program. Vaccines are also widely available through your child's pediatrician, family physician, local county health department, fqhc, or pharmacy. This program will promote entrepreneurialism and job creation. Homeowners not currently receiving the star exemption who meet the program's eligibility requirements may apply for the star tax credit with the new york state department of taxation and finance.

The fresh start program is a collection of changes to the tax code. The irs began fresh start in 2011 to help struggling taxpayers. Ny tax amnesty and/or the irs fresh start program may be possible given the particulars of your situation.

If so, the irs fresh start program for individual taxpayers and small businesses can help. How the ny tax laws compare with the federal (irs) tax laws; The irs launched the fresh start initiative in 2011 for the purpose of helping more taxpayers to get back in good standing.

Well, in reality this is pretty useless. Are you struggling to pay your federal taxes? If you're experiencing or worried about liens, levies, garnishments, or more, now is the time to learn about your options to protect yourself and resolve your tax burden.

This one stop shop for new and beginning. You’ll find all forms of tax incentives, business incentives and tax credits in new york state, all designed to benefit small or expanding businesses as well as film and tv production companies. Previously, the minimum amount of back taxes required to trigger a tax lien was $5,000.

Partnering with these schools gives. And, taxpayers may also waive receiving the said notice if they are going to pay their tax debt via the direct debit installment agreement. We have clear strategies to settle your tax debts for the lowest possible amounts.

If you are registered for the star credit, the tax department will send you a star check in the mail each year. The irs fresh start program has increased this threshold to $10,000, making it easier to avoid tax liens. The fresh start program offers relief from a variety of different forms of tax penalties, including penalties for failing to file a tax return on time, failing to file a tax return at all, failure to pay your taxes on time, and failure to make tax deposits, when required.

As the average age of current farm owners and operators increases across the country, as well as within the state, new farmers are needed to keep agricultural lands in production and to bolster the future of the industry. New farmers are a critical piece of the agricultural landscape in new york state. Tax credits and incentives give new york state businesses a competitive edge.

Raising the dollar amount that triggered federal tax liens (ftls) being filed from $5,000 to $10,000 initially and then to $25,000 a few months later. It offers varying levels of relief and repayment options based on the specific financial situation of each applicant. Irs fresh start programs under federal law provide real relief, but they can be very complexed to navigate.

Center for start services, institute on disability/uced, university of new hampshire 57 regional drive, unit 8, concord, nh 03301 start.iod@unh.edu | phone: The first irs fresh start program is the irs fresh start federal tax lien program. If you are eligible and enrolled in the star program, you’ll receive your benefit each year in one of two ways:

Tax liens against people who don't have much money don't really secure anything for the irs. The school tax relief (star) program offers property tax relief to eligible new york state homeowners. The irs claims it is doing taxpayers a favor by increasing the threshold of tax lien filing from $5,000 to $10,000.

Irs fresh start lien program. The program emphasizes facilitating reasonable repayment options over enacting penalties. Through the fresh start program, the maximum amount of tax liability that would merit a notice of federal tax lien has been increased from $5,000 to $10,000.

0 Response to "Nys Tax Fresh Start Program"

Post a Comment